Altcoins tied to usd

Like gold-backed digital currencies, USD-pegged cryptocurrencies also face the added risk of requiring the storage of large amounts of fiat currency. However, the significant difference between the two designs is that while fiat collateralization typically happens off the blockchain, the cryptocurrency or crypto asset used to back this type of stablecoins is done on the blockchain, using smart contracts in a more decentralized fashion. Thus, investors should be careful to examine who stores the gold for a particular cryptocurrency and where it is housed before investing. Seigniorage-based stablecoins a less popular form of stablecoin.

Ties.DB Latest News

As a business device Ties. Network will be a decentralized social stage where business experts can associate and strike business bargains through keen contracts in a matter of seconds. Current Ties. DB Ties. DB stock price is up by 0.

Step 2: Identifying a Pairing With Your Desired Fiat Currency

The simplest way to cash out your altcoins to USD and other fiat currencies is by going through an exchange that supports fiat conversions. A second exchange is necessary because, unlike Bitcoin, altcoins are not readily convertible to fiat currency. As it stands, only a select few tokens can be exchanged for fiat currencies. Additionally, only a handful of cryptocurrency exchanges can make this trade for you. The need to convert to the proper coin and navigate through multiple exchanges can make cashing out a confusing process.

Step 3: Selecting a Coin to Convert With

The simplest way to cash out your altcoins to USD and other fiat currencies is by going through an exchange that supports fiat conversions. A second exchange is necessary because, unlike Bitcoin, altcoins are not readily convertible to fiat currency. As it stands, only a select few tokens can be exchanged for fiat currencies. Additionally, only a handful of cryptocurrency exchanges can make this trade for you.

The need to convert to the proper coin and navigate through multiple exchanges can make cashing out a confusing process. Follow these simple steps to safely cash out your coins and deposit the funds directly into a bank account.

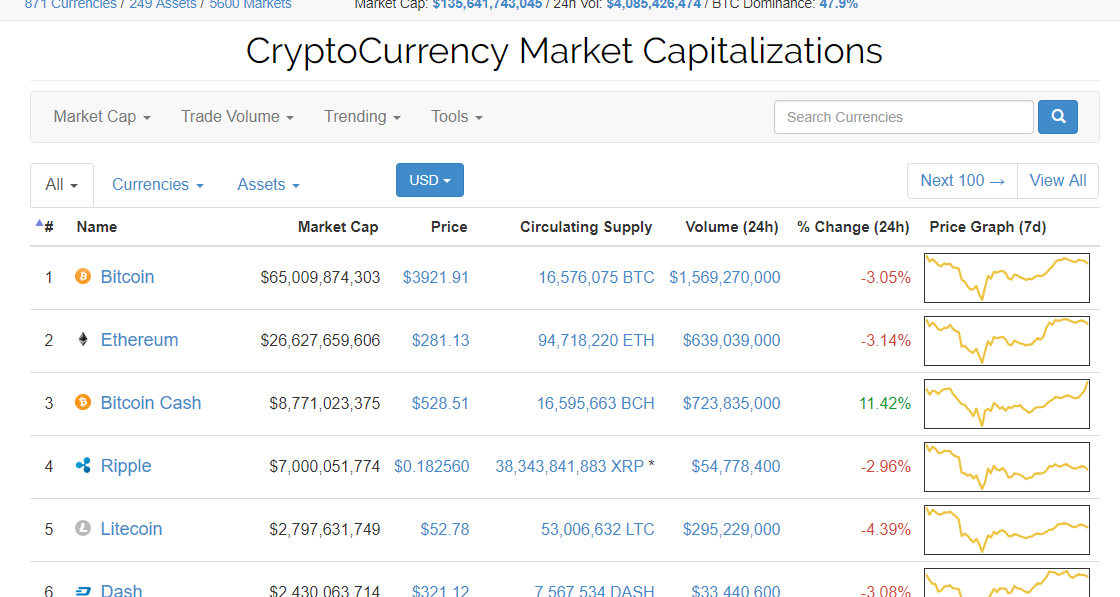

Coinbase and GDAX are two common exchanges that people use to cash out with because they support the 3 most popular fiat currencies. Many also use Gemini and Kraken to exchange their alts for fiat currency. When deciding which exchange you will use to cash out with, consider 1 the available coin-fiat currency pairings and 2 the cost of any Exchange Fees associated with making transactions.

For example, here is what the pairings might look like on GDAX:. For example, many people prefer to convert with Ethereum rather than Bitcoin because Bitcoin has a significantly larger Network fee associated with each transaction. You want the combined total cost of your Network Fees and Exchange Fees to be as low as possible because having more money is fun. After identifying your most cost-effective pairing, you can go ahead and exchange your altcoins for the cryptocurrency in your pairing.

This will most likely be done on the market that currently holds your altcoins. After setting up an account with your desired fiat-compatible exchange, locate the provided public key. On the fiat exchange, navigate to the pairing that has your coin and desired fiat currency.

Select the option to sell on this pairing and enter your desired quantity and price. Place the order. When the market allows for purchase of your coins, the funds will become altcoins tied to usd immediately in your fiat-exchange account. Simply withdraw those funds into your linked financial account. Altcoins tied to usd that your coins have been fully converted into fiat currency, your money should be available on the fiat exchange.

Be aware of the costs you will incur from Network and Exchange fees during this process. You can use the image below to plan your most cost-efficient route for converting altcoins to fiat currencies:. Investors should also understand the potential tax liability associated with trading or converting cryptocurrencies. There was a time when the world cared about the solutions. Now, its all The price dip has been bloody, and no one has felt the impact However, in the background, something….

Currently, it is a one-stop-shop crypto app that includes an aggregated crypto exchange the combination of several exchanges to deliver optimum pricessafe cryptocurrency storage through insured custodianship, a payment card and all the traditional alt-banking….

Phillip is a crypto-enthusiast and Industrial Engineering student at the University of Florida. His focus is on learning about blockchain technology as it relates to transforming future industries. Phillip Moskov.

How to Convert Altcoins? How to Cash Out Altcoins? Newsletter Sidebar. This field is for validation purposes and should be left unchanged. Read More. Press Releases.

Top 5 Altcoins to Invest in 2020 (MUST WATCH)

How much is 1 Ties.DB in US Dollar?

USD-Pegged Cryptocurrencies». Your Practice. Personal Finance. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. Please help improve this article by adding citations to reliable sources. His focus is on learning about blockchain technology as it relates to transforming future industries. Proof of authority Proof of space Proof of stake Proof of work. This article needs additional citations tird verification. By using this site, you agree to the Terms of Use and Privacy Policy. Your Money. Unsourced material may be challenged and removed.

Comments

Post a Comment